What is SCN in GST? Meaning, Reasons & Response

- 24 Sep 25

- 11 mins

What is SCN in GST? Meaning, Reasons & Response

Key Takeaways

- SCN in GST is an official notice issued by tax authorities, asking taxpayers to justify suspected non-compliance.

- A Show Cause Notice ensures natural justice by giving taxpayers a fair chance to explain before penalties are imposed.

- Common reasons for SCN include tax evasion, wrongful ITC claims, erroneous refunds, or delayed return filing.

- Failing to respond to SCN can lead to penalties, recovery proceedings, or cancellation of GST registration.

- To handle an SCN effectively, read carefully, collect documents, consult experts, and reply within the deadline.

Receiving a notice from the tax authority can feel pretty overwhelming for anyone running a business or even for individuals. One of the most important modes of communication you might encounter is the Show Cause Notice (SCN).

When you find yourself wondering what is SCN in GST (Goods and Services Tax, it is simply an official notice by the GST department, requiring you to explain or justify your actions, which could have been perceived as going against the GST law. It is crucial to understand how to react properly and remain compliant and guarantee that your business will continue operating successfully.

What is a Show Cause Notice Under GST?

GST authorities issue a show cause or formal notice (SCN) to a taxpayer, formally asking them to explain why they should not face a penalty for a specific action or inaction.

Issuing SCN is an important legal action of the adjudication process as this notice provides taxpayers with a fair opportunity to have a hearing before punishment. It is normally served by a proper officer authorised under GST law to initiate such proceedings.

The SCN upholds the principle of natural justice by giving taxpayers a chance to defend themselves and by promoting transparency in tax administration. It does not declare any final decision but acts as a preliminary step before imposing any penalty, affirming the taxpayer’s right to be heard.

What Does a Show Cause Notice Contain?

The standard format of an SCN features multiple key elements. This information explains the alleged violation and the basis for the proposed action to the taxpayer.

You can check the below-mentioned information in an SCN:

- SCN number accompanied by the date of issuance

- GSTIN (GST registration number of the business)

- Name and address of the recipient

- Concerned tax period and the financial year under question

- Reference to the addressed sections of GST law

- Summary of the case

- Grounds for the proposed action

- Specifics of the due amount, interest, penalty, etc.

- The time frame for submitting a detailed response

- Consequences of non-compliance

Including these details makes sure that the recipient understands the allegations and the legal aspects at play, allowing them to craft a well-informed and thorough response.

Why is an SCN Issued?

The main goal of sending out a show cause notice is to give taxpayers a chance to clarify or defend their actions that the tax authority suspects have violated GST rules. This approach supports the idea of natural justice and helps prevent any arbitrary decisions from the authorities.

The concerned officer typically raises an SCN when they believe there has been some form of non-compliance, such as failing to pay taxes, underpaying them, wrongly claiming or using input tax credit (ITC), or claiming excessive refunds. The officer may also issue it in cases of suspected fraud, deliberate misrepresentation, or attempts to hide crucial business-related information like the annual return.

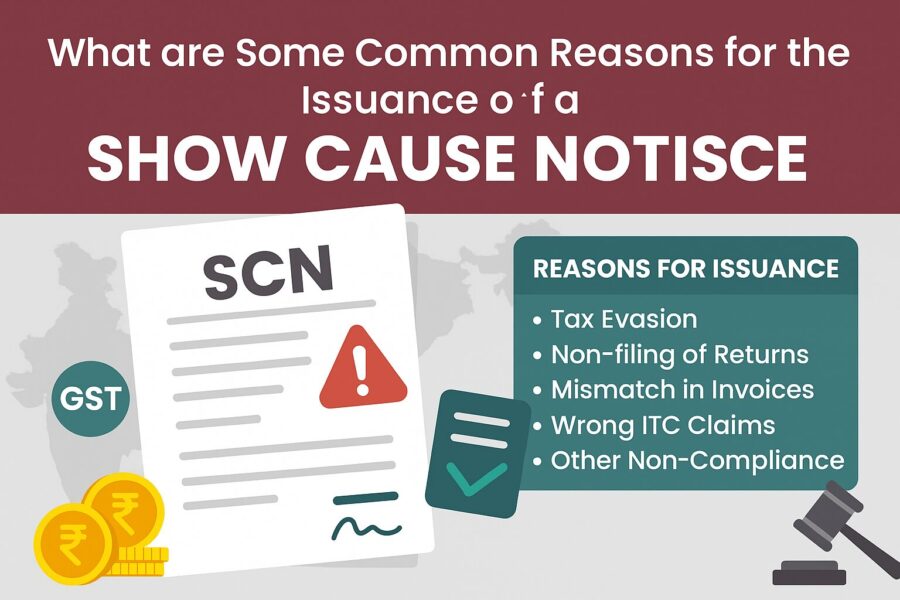

What are Some Common Reasons for the Issuance of a Show Cause Notice?

A show cause notice under GST can be issued for a number of reasons that include but are not limited to:

- Non-payment or Short Payment of Tax: This happens when the correct amount of GST which is supposed to be paid in relation to a given period is not paid.

- Wrongful Availment or Utilisation of Input Tax Credit: It refers to availing of ITC when eligibility or documents are not fulfilled or using the input credit in a manner not covered by the GST law.

- Erroneous Refunds: This can happen when a taxpayer receives a GST refund to which he or she was not entitled.

- Non-Filing or Delayed Filing of Returns: Any defaults or delays in the proceedings of filing the periodic GST returns will be in contravention under this ground.

- Tax Evasion: This involves an attempt to conceal taxable transactions, under-reporting sales or exaggerating purchases.

- Fraud or Wilful Misstatement: This can be explained as various activities that may indicate that there was a motive of misrepresentation or hiding of certain facts with a view of avoiding payment of the right amounts of tax.

- Non-compliance to Audit Findings: These would consist of cases where differences or abnormalities are identified after GST audits.

- Non-payment of Tax Collected: It means that GST is imposed on customers, and there is the subsequent default in paying the same amount to the government.

Now that you are aware of the triggers, you can better manage compliance and minimise the chances of receiving an alert in the form of a show cause notice.

What if You Fail to Reply Correctly to a Show Cause Notice?

Ignoring or not properly addressing a show cause notice can lead to some serious repercussions:

- Ex-Parte Orders: If you do not respond, the relevant officer may issue an order based solely on the evidence at hand, without taking your side of the story into account.

- Confirmation of Demand: The proposed tax, along with any interest and penalties, could be confirmed in full, resulting in a formal demand for payment.

- Initiation of Recovery Proceedings: The tax authority has the power to initiate recovery actions, like seizing bank accounts or property, to collect what you owe.

- Suspension or Cancellation of GST Registration: If you keep ignoring these notices, you risk having your GST registration suspended or even cancelled, which can seriously disrupt your business operations.

- Negative Impact on Compliance Rating: Overlooking an SCN can hurt your GST compliance score, leading to more scrutiny down the line.

So, it is crucial to take every SCN seriously, respond within the given timeframe, and make sure your reply is thorough and well-documented.

How to Handle a Show Cause Notice Under GST?

A show cause notice can be intimidating to handle, despite there is a way to systematically address it:

1. Read the Notice Carefully

Make sure you take time to properly comprehend the allegations, the legal citations made and the particular information or documents that are being sought.

2. Collect Documentation and Evidence

Gather all relevant records in this regard such as invoices, returns, payment challans, and any other correspondence that could support your claim. Ensure that you target documents that have input tax credit, tax payments and returns that have been filed.

3. Consult the Professionals

You should consider seeking advice from a GST practitioner, tax consultant or legal professional who may assist you in reviewing the notice and drafting a solid reply. Their knowledge can get you out of the complicated legal issues and prevent any unwanted confessions.

4. Prepare a Detailed Response

In your reply, you must address each allegation point by point by giving factual explanations, and legal arguments and enclosing any supportive documents. Be precise on your approach regarding each of the issues mentioned in the show cause notice.

5. Meet Time Limit

Be sure to mail your responses before the deadline mentioned in the notice, normally 30 days, but it may be less. In case you require an extension of time, you may apply to the appropriate officer to be given an extension of time stating your reason.

6. Attend Personal Hearings

When the tax authority requests a hearing, ensure that you appear in time and plead your case either personally or by an authorised person. It is an excellent opportunity to remove the doubts and support your points.

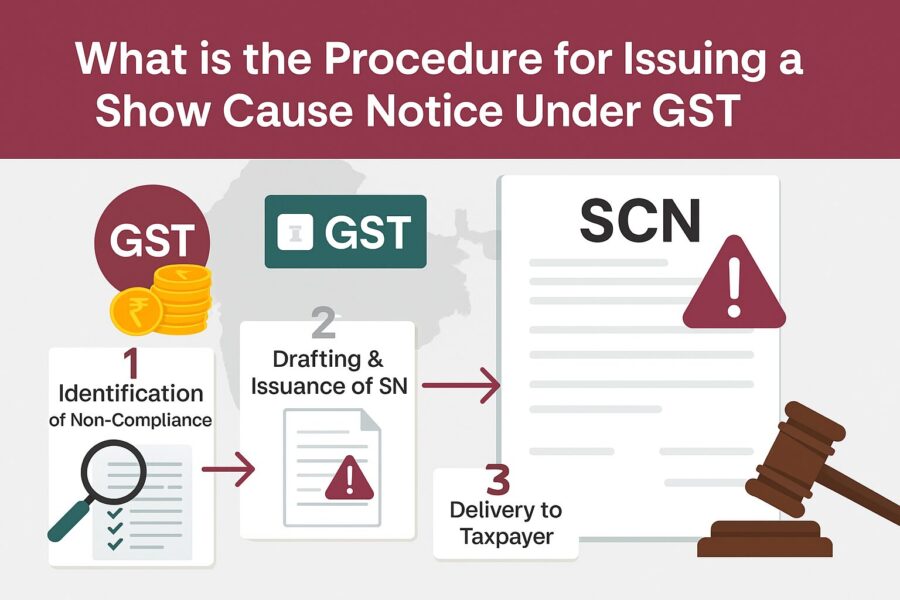

What is the Procedure for Issuing a Show Cause Notice Under GST?

The process of issuing and dealing with a show cause notice is very much organised. Provided below, you can find the way the tax authorities complete their job:

Step 1: Identification of Non-Compliance via Investigation Proceedings

The proper officer, whether by means of audits, investigation, or data analysis, identifies potential infringements such as unpaid taxes, erroneous ITC claims, or refund errors.

Step 2: The SCN Drafting and Transmission

Next, the officer prepares the SCN, which includes a description of the facts in detail, legal grounds and proposed courses of action. The authorities formally notify the taxpayer, sometimes attaching a summary in Form GST DRC-01.

Step 3: Designation of a Response Time

They give the taxpayer a specific period of time to reply, which is usually around 30 days, though this may vary case by case.

Step 4: Response and Hearing Review

Once the officer receives a timely response, they analyse the evidence and may hold a personal hearing, giving the taxpayer a chance to plead their case, either personally or through an agent.

Step 5: Passing a Decision and Order

Upon considering the entire information, the officer comes up with an order, which can either affirm, modify, or reject the demanding proposal. The authority then conveys this decision to the person concerned, and if it is unfavourable, they may initiate recoveries.

Step 6: Complying with the Right to Appeal as a Taxpayer

In case of dissatisfaction with the order by the taxable person, they get a chance to appeal to a higher authority within the stipulated time.

Conclusion

Show cause notice is a significant component of the GST regime, and it serves the crucial purpose of assuring compliance and accountability. If you ever happen to ask yourself, ‘What is SCN in GST’, you can remind yourself that it is an opportunity to clarify a taxpayer’s position before any adverse measures are taken.

It is important to act quickly and comprehensively, with the assistance of legal advice and appropriate documents in order to save your business and maintain a proper relationship with the tax authorities.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.